Audit shows plunder of taxpayers cash across counties

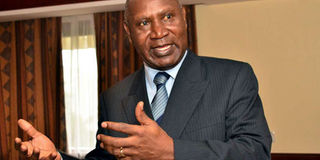

Auditor-General Edward Ouko speaks during a meeting on November 14, 2017. His report shows that the Machakos Assembly failed to explain an expenditure of Sh119 million paid to staff as salaries. PHOTO | FRANCIS NDERITU | NATION MEDIA GROUP

What you need to know:

- In the report for the 2015/16 financial year, some of the county assemblies also failed to bank revenues.

- Kwale could not explain Sh20 million as reflected in its fund balance forwarded to the auditor.

The latest report by the Auditor-General has revealed massive plunder of public resources that could have otherwise been spent on development in counties.

The report seen on Tuesday by the Nation, for instance, reveals how ward representatives irregularly spent millions of public funds on trips, allowances, leisure and constructions.

The communication says the MCAs either used the funds for the purposes with which they were not intended, or failed to provide supporting documents of the expenses incurred.

REVENUE

In the report for the 2015/16 financial year, some of the county assemblies, like Nairobi for instance, also failed to bank revenues running into millions of shillings.

The city county, says Mr Edward Ouko, failed to bank Sh69.5 million it earned from revenues.

This is beside failure by the House to account for Sh207 million it used in the purchase of goods and services.

The Assembly, Mr Ouko says, spent Sh510 million on goods and services, but expenditure amounting to Sh207 million was not supported by detailed ledger record.

“In the circumstance, it was not possible to confirm the propriety of the unsupported expenditure of Sh207 million on use of goods and services.”

ALLOWANCES

In Kiambu County, MCAs were paid an extra allowance of Sh1.2 million as per diem for a workshop held in Naivasha.

According to Mr Ouko, the MCAs were paid Sh2.4 million for a two-day consultative meeting, yet it was scheduled to last for a day.

Records presented for audit also indicated that the assembly did not deduct and remit taxes as required and hence penalties and interest amounting to Sh11.9 million accrued.

Further, there was impropriety in deduction of members mortgage and car loans, as most deductions were made as cash from sitting allowances.

The MCAs further spent Sh176 million on domestic and international trips, as well as the purchase of hospitality supplies and services.

“There was also a lack of prudence in use of public funds after MCAs were paid a total 17.1 million as allowances for meetings organised without specific agendas for discussion,” Mr Ouko says.

EMPLOYEES

Records maintained by the Machakos Assembly failed to explain an expenditure of Sh119 million paid to staff as salaries.

According to the report, the annual basic salaries for staff amounting to Sh154 million differed with the integrated payroll and personnel database system total annual basic pay amount of Sh35 million by Sh119 million.

Further, 30 new employees introduced into the payroll on September 1, 2015, were unsupported with proof of recruitment and subsequent placement.

“Another variance of Sh6 million was noted in the salaries for temporary employees.

"The Assembly’s approved budget was Sh883 million against a total expenditure of Sh822 million, resulting in an under-expenditure of Sh60 million or approximately seven per cent of the approved budget,” the report says.

TENDERS

In Makueni, there were irregular construction works of an office block, wall padding, septic tank, and drainage system, parking bay and landscaping, cafeteria and kitchen, all totalling to Sh27.5 million.

Mr Ouko says that several anomalies were noted in relation to the tenders like poor construction leading to lack of value for money, lack of documentary evidence to support payments as well as non-compliance with tender agreements.

The assembly also paid Sh52 million to a law firm for legal services that were not offered.

This amount, the report says, was inclusive of Sh44 million paid for unspecified and unsupported issues.

FINANCIAL RECORDS

At the Coast, billions of shillings spent by six counties in the region for the year ending 2016 cannot be accurately accounted for.

Mr Ouko cites inaccuracies in filing of financial records.

Mombasa led with discrepancies amounting to Sh7 billion, followed by Lamu with Sh5 billion, which contradicts IFMIS.

Kwale could not explain Sh20 million as reflected in its fund balance forwarded to the auditor.

For Kilifi, Sh25 million did not reconcile with the statements of receipt and payments, which differ with a summary of appropriation.

LOAN REPAYMENT

Tana River and Taita Taveta financial statements did not comply with the requirements of International Public Sector Accounting Standards.

This is as prescribed by the Public Sector Accounting Standards Board.

Anomalies noted in the six counties were unsupported adjustments, unauthorized expenditures, and undisclosed bank accounts among others.

“The statement of assets as at June 30 reflects bank balance of Sh368,211,091. However, induced in the bank balance is an amount of Sh281,172,027 being bank balance of 12 bank accounts and whose cashbooks, bank reconciliation statements and bank certificates were not availed for audit...” the report for Mombasa reads in part.

In Narok, the Assembly car loan repayment status report indicated that as at June 30, 2016, only Sh69,881,083 million representing 70 per cent had been repaid out of the total amount of Sh99,930,778 million.

LOSSES

The mortgage loan repayment status report for the same period indicated that Sh4.56 million, representing just 36 per cent, had been repaid while Sh8 million was outstanding.

According to the auditor, given the slow rate of recovery of the loans, the outstanding amounts could only be amortized in 20 or more months from June 30, 2016, which was impossible.

The auditor warned that the loans and mortgages fund was likely to suffer losses after the expiry of the term of the MCAs since the administrator had not made arrangements for complete recovery of the debts.

LOGBOOKS

In Samburu, the outstanding loan balance owed by 27 MCAs as at June 30, 2016 was Sh61.9 million.

“Further, loans were granted in absence of mortgage protection and fire policies issued by an insurance firm approved by the committee,” the report states.

The auditor also noted that the few car logbooks presented for audit verification indicated that vehicles obtained using the loans were not co-owned by the respective borrowers and the county authorities, hence it was not possible to confirm that the vehicles were bought through the proceeds of the car-loan scheme and whether there existed proper collateral for the amounts advanced.

CONFERENCES

The auditor also noted that given the monthly loan repayments due from the borrowers, Sh21.7 million worth of loans were at risk of having not been collected at the expiry of the last term of the MCAs, putting the assembly at risk of losing the amount.

In Nyandarua, the Assembly spent Sh23 million as daily subsistence allowances for MCAs and staff and hire of conference facilities for various House committees.

Reports by Silas Apollo, Caroline Wafula, Mohamed Ahmed and Eric Matara